Hello, we are Luko, a brand of Allianz Direct

Our mission? Be your #1 customer centric insurer

We created Luko with a simple vision.

50% of consumers don’t trust their insurer, yet it is mandatory in many cases and it is the only stakeholder you can turn to when a damage occurs in your home. So, we decided to reinvent insurance to make it finally customer-centric like we believe it was meant to be.

We started by creating the most transparent and useful insurance company out there: one that you can finally trust, because its business model was designed for a positive impact and because its product experience is meant to empower users rather than mislead them.

We created the most intuitive and user-obsessed insurance experience you can wish for: one that you can take out in less than 2 minutes, one that gives you access to an advisor in less than 100 seconds, and one where you report your claim hassle-free in 5 minutes from your smartphone.

In 6 years, we have convinced over 400,000 users to trust us. We rapidly became the online home insurance market, putting technology at the service of customer satisfaction and operational efficiency: by 2022, 25% of home insurance policies sold online in France were Luko policies; and nearly one in two new Luko customers took out a policy on the recommendation of friends and family.

In February 2024, Luko joined Allianz Direct, the digital pan-European subsidiary of the Allianz Group. Driven by the mission to become "digitally unbeatable", Allianz Direct has set new standards in the digital insurance landscape across Europe with its intuitive and intelligent insurance offerings.

By joining forces, our mission remains the same: to shake up the market by offering the best value for money, provide more simplicity and transparency, and to become the market leader in direct insurance market in France!

- Insurees

- Years of average age

- % of women

- % of full-remote teammates

- Different nationalities

- /5 on Google

- minutes to answer our users

- average NPS after a chat with us

- lukooms

Look back at Luko's engagements

Discover some of the Lukooms and things we do

Claire, Product Manager

Yassine, Customer Success

Here’s what it’s like to work at Luko

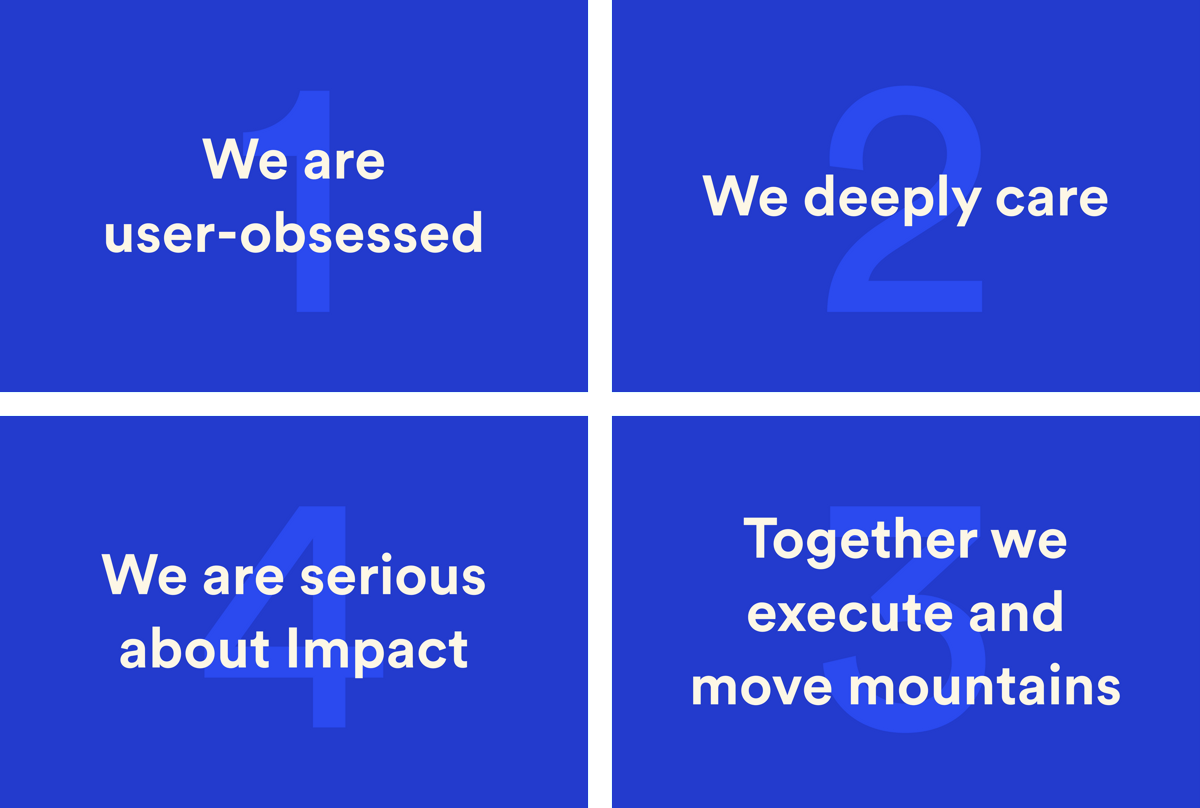

Working at Luko is embracing the Luko Way. We strongly believe this set of values defined by the team is what drives us on a daily basis, makes us a united team and helps us deliver a 1% better experience to our users every day.

You're here because of our LinkedIn surveys? Here are the latest answers!

-

Turns out French people's average mortgage insurance is 15.000 € too expensive for one's profile, so that's why we decided to craft a mortgage insurance that's finally fair.

-

About 1/4 of new Luko users, and even if it's not the majority of them, we're really proud of providing an experience worth recommending for our users. Because honestly... who talks about an insurer if it's not because there's something wrong?

-

Only 50% of French people trust their insurance according to a YouGov survey. Which means the other half is tied to an insurer they don't trust. So that's why we decided to implement the Giveback into our business model, finally realigning interests of everyone.